Group LIFEfit can support both individual & group business at the same time.

| Types of groups: - Association groups

- Employer

- White-label groups

Product types:

All contracts: mortality, unit linked, pensions, deposit administration, school fees, annuities Credit Risk, Term, Accident, Mortgage, Credit Life

Pensions:

Pensions administration include Annuities, Deposit Administration (with or without Bonus distribution), Personal Pensions, Unit Linked, Internal funds, Defined contributions. | | | | Group product lifecycle on LIFEfit:

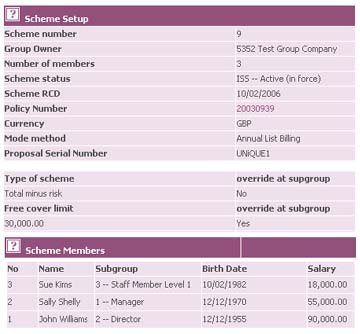

- detailed client/scheme and sub-scheme/category member

- member status - add new members to the group scheme, terminate existing group members, transfer member from group to individual scheme

- list billing - grouped contribution collection and reconciliation, employer or employee contributions, additional voluntary contributions

- multiple riders - added to the group member policy eg. terminal, illness cover, life cover, accidental death benefit cover. The premium for the rider can be collected with the main policy or by deducting units after the premium is allocated.

- new business quotations and benefit targeting

- investment and risk combinations with schemes

- salary and contribution histories

- core scheme selections and overriding member choice

- retirement investment strategy recording and fulfilment

- integrated death benefit and waiver of premium processing

- tax monitoring and reporting

- full and multiple benefit selection and claims processing

- documentation at company & product level for group policy & certificate; user-defined event-driven

- selling on a case-by-case basis or census basis

- historical information to show changes in member status, class, number of dependants

|